Hear from Idwal CEO on the importance of comparison to spot outliers in your fleet who could become subject to increased scrutiny that could affect the tradability of your ship.

In September, 2022, we visited Singapore in our first visit to Marine Money Week Asia since the pandemic. Whilst the team were out busy meeting clients, colleagues and old friends, I had the opportunity to present some of the most recent developments at Idwal, including updates to our data that allows our clients to spot risks, before they affect the crew or tradability of the vessel.

The Importance of Inspection Data in Understanding Asset Risk

Ensuring you have a clear insight into the condition of your vessels can provide a valuable tool for owners, managers, and financers. Data comparison allows you to spot clear outliers in your fleet that could potentially become under increased scrutiny during port state control inspections that could effect the tradability of your vessel. But how to spot them? Let us two you a tale of two vessels.

Key takeaway

Using data, standard methodology and inspecting your ships can be a real proactive tool and help prevent trading risks. It also helps present a number of other things things like:

- Value depreciation

- Increases in Opex and Capex

- Reduces employability risk, and also other issues with statutory class

- Softer issues like crew welfare and retention

The key takeaway from of us (of course), is that it really is about inspecting the ships. It is the number one risk tool and if we do it consistently, if we do it accurately, and if we leverage and harness that data businesses around the world can protect themselves from that downside risk.

A tale of two vessels

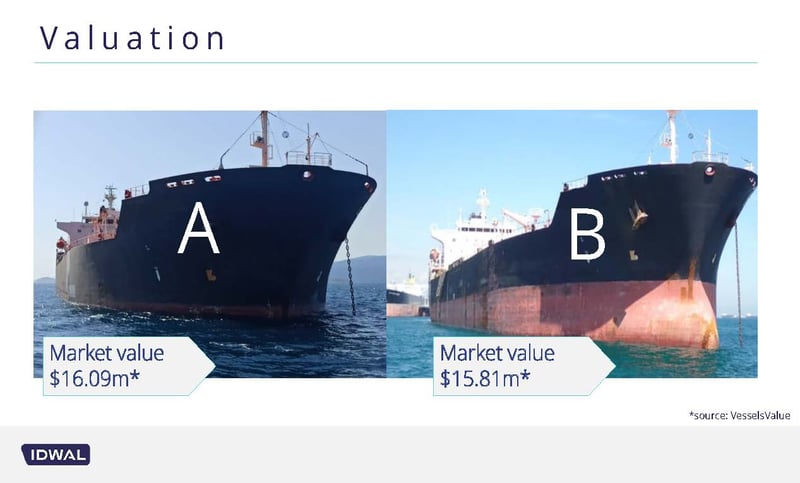

We begin by comparing two ships that Idwal have recently inspected. Ship A and Ship B are both MR Tankers and both built in Korea 14 years ago. They are sister ships built and delivered within a couple of months of each other and inspected very close together; both operated by what we would consider to be recognized industry players. At the time of the inspection, market values were around about the same at around 16 million for Ship A and just under 16 million for Ship B.

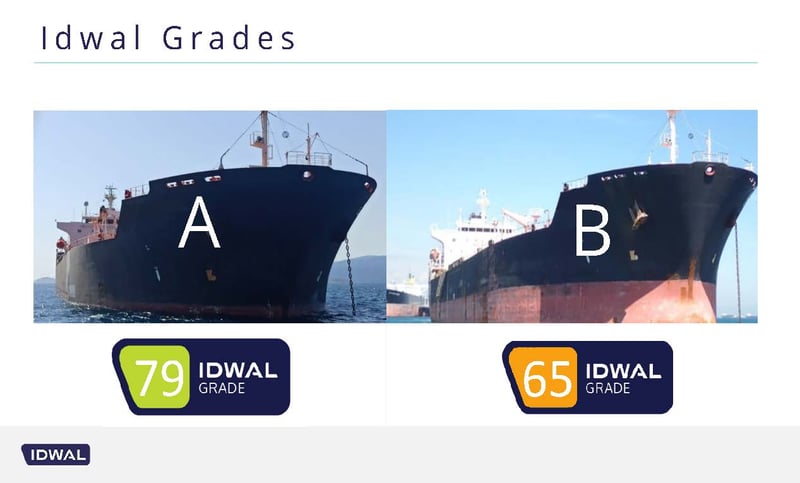

The grades on inspection however, told a different tale. Something is wrong here, with a clear chasm between the condition of the two ships. Ship A achieved an Idwal Grade of 79 (which is relatively high) and Ship B achieved a 65 (which is low).

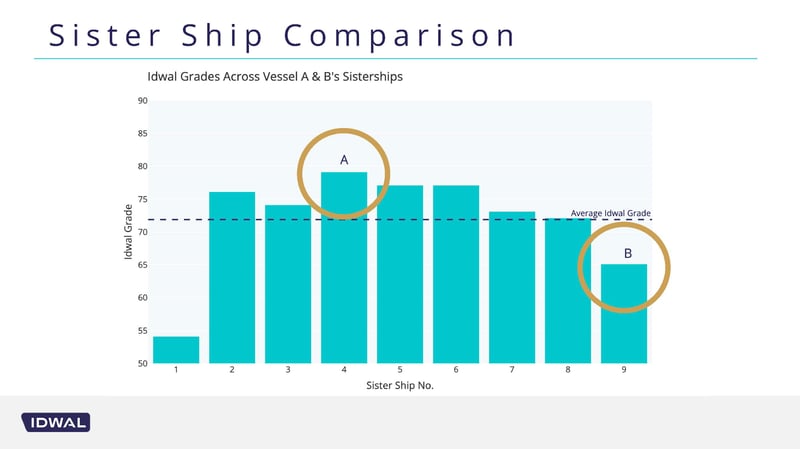

So how do these two vessels shape up to the sister-fleet? Is this a symptom of something sinister? Collating the sister-vessel grades from Idwal inspections, we can clearly see that a majority of the fleet is operating nicely in good condition. Ship A is actually in the best condition of the entire fleet. But Ship B falls down quite significantly beneath the average for that group.

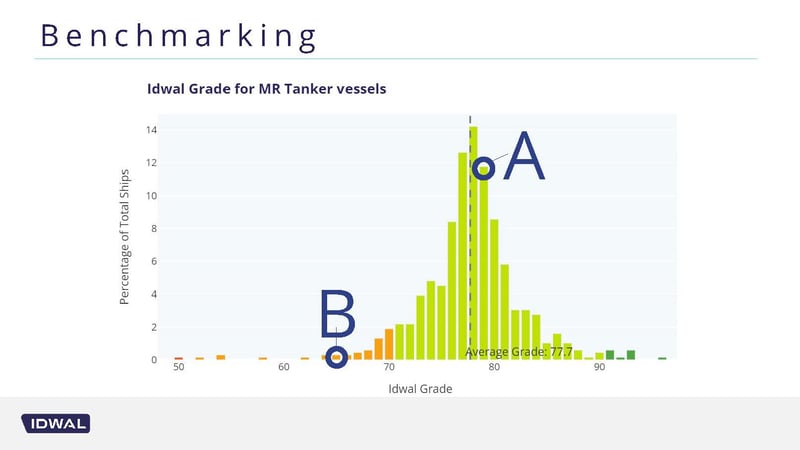

So now we look at the ships against the MR Tankers segment as a whole. We collated the data of all vessels around the same age and type and again what you are seeing is Ship A above the industry average, and Ship B really lagging behind the industry average. At this point, it's abundantly clear to us that something is wrong.

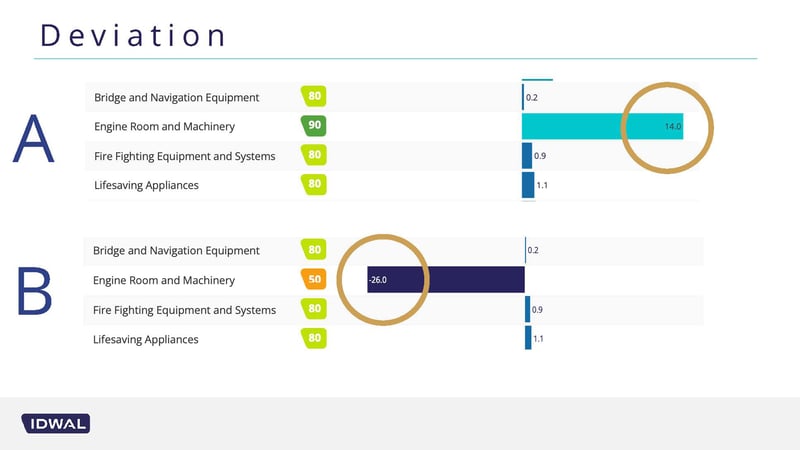

But what is the issue? The answer lies in the inspection report. The Idwal Grade is made of up of a plethora of subcomponents that allow us to compare individual areas of the vessel to the industry average. Again, you can see in the chart that Ship A is coming in above average for many of the subcomponents - indicated by the light blue. And once again, Ship B is coming almost entirely below the industry average (indicated by the dark blue( with the Machinery and Engine Room subcomponent being a clear outlier amongst all other areas. This gives us a clear indicator of an issue, and an area to focus on.

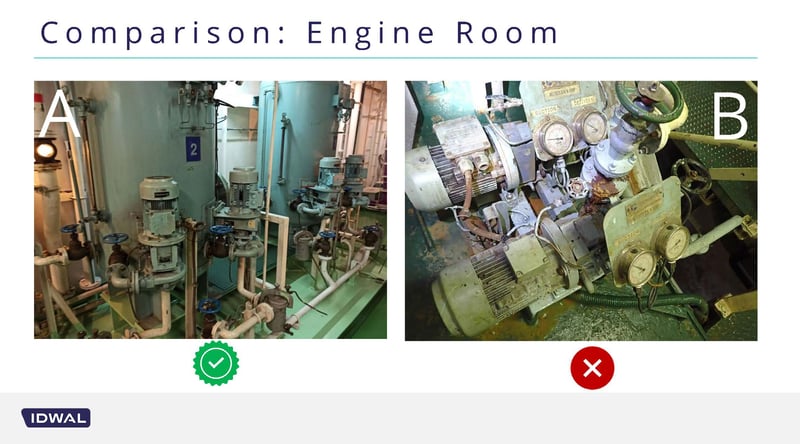

Everything at Idwal operates from the ground up. We are inspecting the ships physically to take evidence based on what our surveyors are seeing, with every report featuring hundreds of images taken during the inspection. Ship A's engine room is nice, clean, and well maintained but with Ship B, the problems are immediately apparent with dirty machinery, oil leaks, and bad maintenance records, This is a key area where PSC vetting inspectors are going to come to on your ship, and they will give deficiencies and defects that will then directly cause tradability problems.

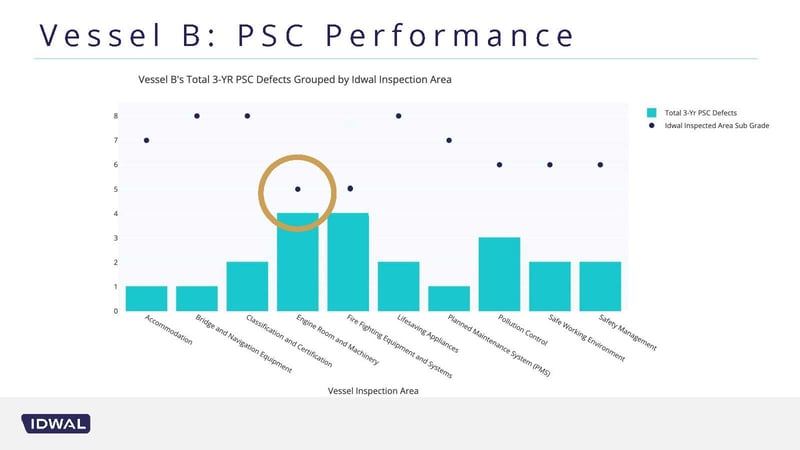

Next, we look at the deficiencies of Ship B and in particular, the Port State Control Records to see what is going on. With the records, there is a clear correlation between our data and the PSC data. What we can see here is the engine room and machinery grouping of the PSC data is neatly correlated to the low Idwal Grade that we give in that sub-component. It acts as a clear indicator of what is happening in international vetting and PSC regimes. As an aside, I think ship B had something like 26 Port State controlled efficiencies across 11 inspections so that's that's a ratio of about 2.36 - which is way above any KPI Target that you would see from any any credible ship manager in the market.

What can this data do? It can give owners and managers an opportunity to perform risk-based inspections well in advance of any PSC vetting and thus, mitigating any chance of any kind of tradability issues.

So what can we conclude from this? Taking a proactive inspection approach to your risk management program allows to really find out what those key areas are that could cause issues for your vessel. It allows you to address them and prevent the issues before they become an issue with vetting, trading, or port state controls. It can assist with/prevent:

- Value depreciation

- Increased opex

- Increased capex

- Charter risk

- Detention risk

- Trading interruptions

- Statutory and Class issues

- Reputational problems

- Crew retention

Submit a comment